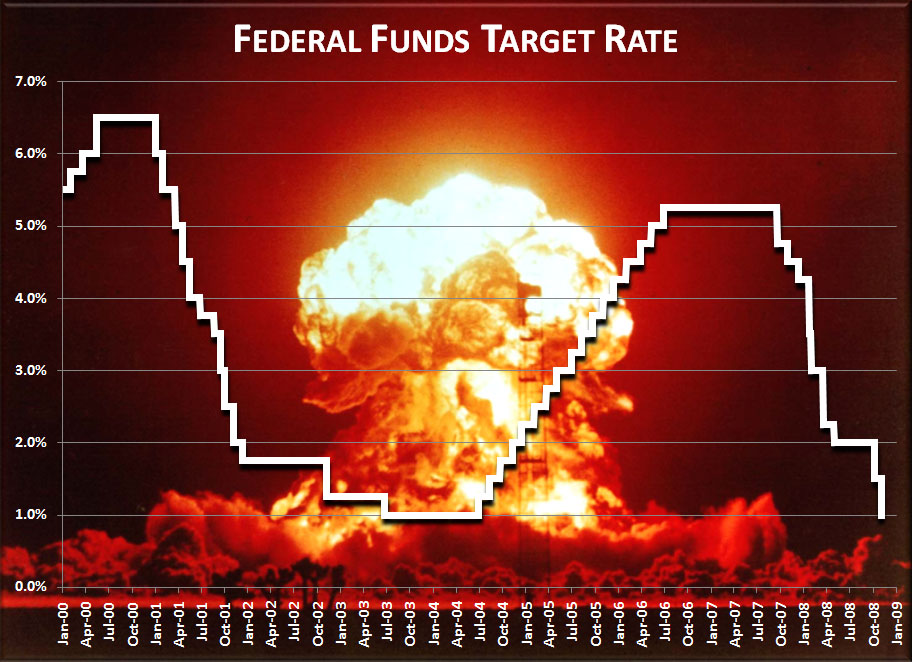

In a panicked move Wednesday, the Federal Reserve cut its benchmark interest rate by half a percentage point to one percent, guaranteeing the worst U.S. economic downturn in the postwar era, if not the worst of all time.

“Recent policy actions, including today’s rate reduction, should help to amplify the downside risks to growth which remain,” said the Federal Open Market Committee in yesterday’s statement.

Central bankers worldwide are desperately trying to cash out and sock away as much money as they possibly can before the self-reinforcing downturn in consumer spending and bank lending inevitably lead to a deep, prolonged global recession.

“When Japan was faced with a similar crisis in the early 1990s, they dropped interest rates to zero, resulting in decades-long economic stagnation,” said Federal Reserve Chairman Ben Bernanke. “Protracted economic collapse seemed like some pretty good times over in the land of the rising sun, so we thought we’d go ahead and make sure the same thing happens over here.”

“Total economic collapse is far preferable to the alternative,” said Bernanke. “I mean, the last thing we want to have happen is for any of the institutions or individuals responsible for driving the economy up into this unsustainable, credit-based bubble to be held accountable in any way.”

The Fed’s move was welcomed by the markets, which rapidly gained ten percent, then immediately lost fifteen percent following the news.

Economists predict that the Federal Reserve’s moves in combination with recent billion-dollar bailouts and other irresponsible, incomprehensibly expensive moves by the federal government will send the U.S.—and possibly the entire planet—into the worst recession in recorded history.

In order to survive the coming mega-ultra-depression, experts recommend stocking up on rice, silly putty, and twine. Sell any possessions that you don’t use for at least four hours a day, never throw away anything, and only talk to people that you trust completely—which should be no one.

A comprehensive survey of investment managers showed that safe investments in the coming apoca-cession include peanut futures, drug companies that manufacture antidepressants, and lava lamps.

Depending on how quickly the economy crashes to absolute bottom, the Federal Reserve has indicated that they will continue to drop rates all the way to zero—possibly as early as December.

“Our target is one hundred percent economic decimation by July of 2009,” said Bernanke. “The American people can rest assured that we will do whatever it takes to achieve this goal.”

DISCLAIMER:

If you lose money following the above “investment strategies,” we will pay you back one thousand times your losses! The Naked Loon is so confident in our “investment advice” that we specifically guarantee you will profit, NO MATTER WHAT.

Note: Funds used to pay back losses incurred will be raised through an auction of all your possessions and possibly your family members. But don’t worry—these investment strategies can’t fail.

Be the first to comment on "Fed Cuts Rate to 1% to Ensure Prolonged Recession"